应“双支柱”方案要求,多国已经承诺在支柱一生效后将取消征收数字服务税以及其他相关类似单边措施

收集整理:思迈特财税国际税收服务团队

日期:2021年12月7日

TPGUIDER按:随着全球商业环境的巨大变化,传统的税收管理在当今时代已体现出诸多不适应,如互联网的兴起为纳税人(主要为美国跨国科技公司)选择纳税地点扩大了自由度,使得数字经济的市场国分享的利润极其有限,进而让各国的税收收入两极分化。对此,2018年3月欧盟委员会就数字化业务活动征税的新方式立法提案,并提出征收数字服务税(DST)的反避税手段。

然而对于征收数字服务税的反避税手段,仅在欧盟内部就有着两派对立的态度,以爱尔兰、荷兰及卢森堡为反对代表的一方,因跨国科技公司在其内部产生的高额利润而受益;而以英国、法国及西班牙为支持代表的另一方,出于自身利益的考虑,对数字服务税实行单边税收措施。对于征收单边数字服务税的举措,美国贸易代表办公室认定该举措对美国公司具有“歧视性”,违背了现行国际税收基本原则,并对部分征收数字服务税的国家进行了关税反制。

由于多方在数字经济的税收问题上难以统一意见,故OECD受G20委托,旨在就数字经济税收问题达成多边解决方案。2019年2月,OECD在《应对数字经济带来的税收挑战的政策说明文档》中,首次提出“双支柱”解决方案;2021年7月,OECD发布声明,130个国家(地区)支持“双支柱”解决方案;2021年10月8日,OECD再次发布声明,在7月共识的基础上,BEPS包容性框架下140个成员中的136个国家(地区)就“双支柱”解决方案达成共识,要求所有缔约方撤销对所有企业的所有数字服务税以及其他相关类似单边措施,并承诺未来不再引入类似措施。声明还要求,自2021年10月8日起,至2023年12月31日和多边公约生效日中较早一日,各辖区不得对任何企业实施新立法的数字服务税或者其他相关类似单边措施。将妥善协调撤销现行数字服务税以及其他相关类似措施的方式。

需要注意的是:上述数字服务税只是一种狭义概念,特指上述欧盟等国家采取的临时性征收数字服务税。而广义上的数字服务税,还包括对数字经济本身征收的增值税等流转税税种,这些并不在上述声明撤销之列。为了适用数字经济时代,传统税制也会有相应变革,以更好对数字服务征税。

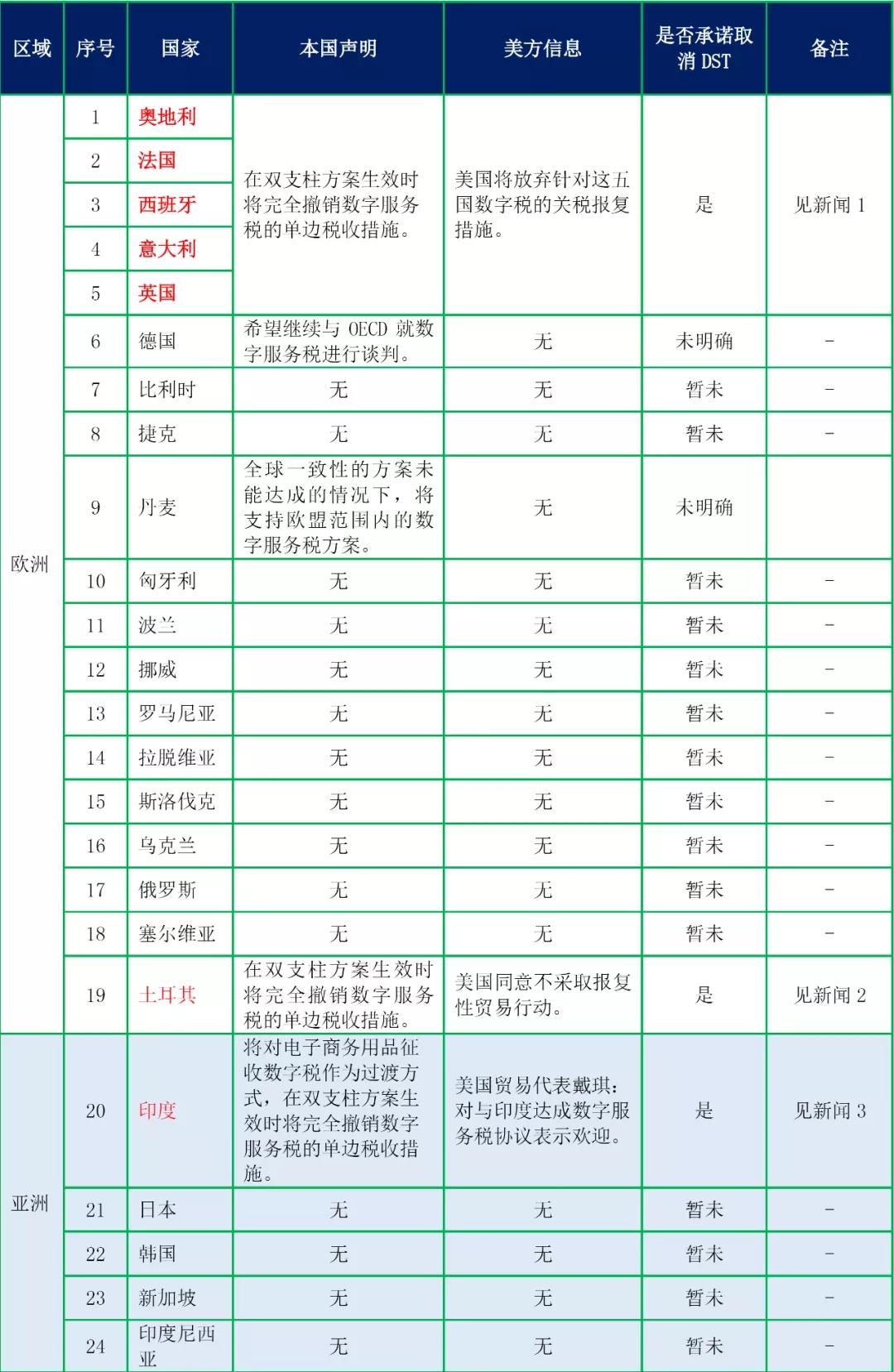

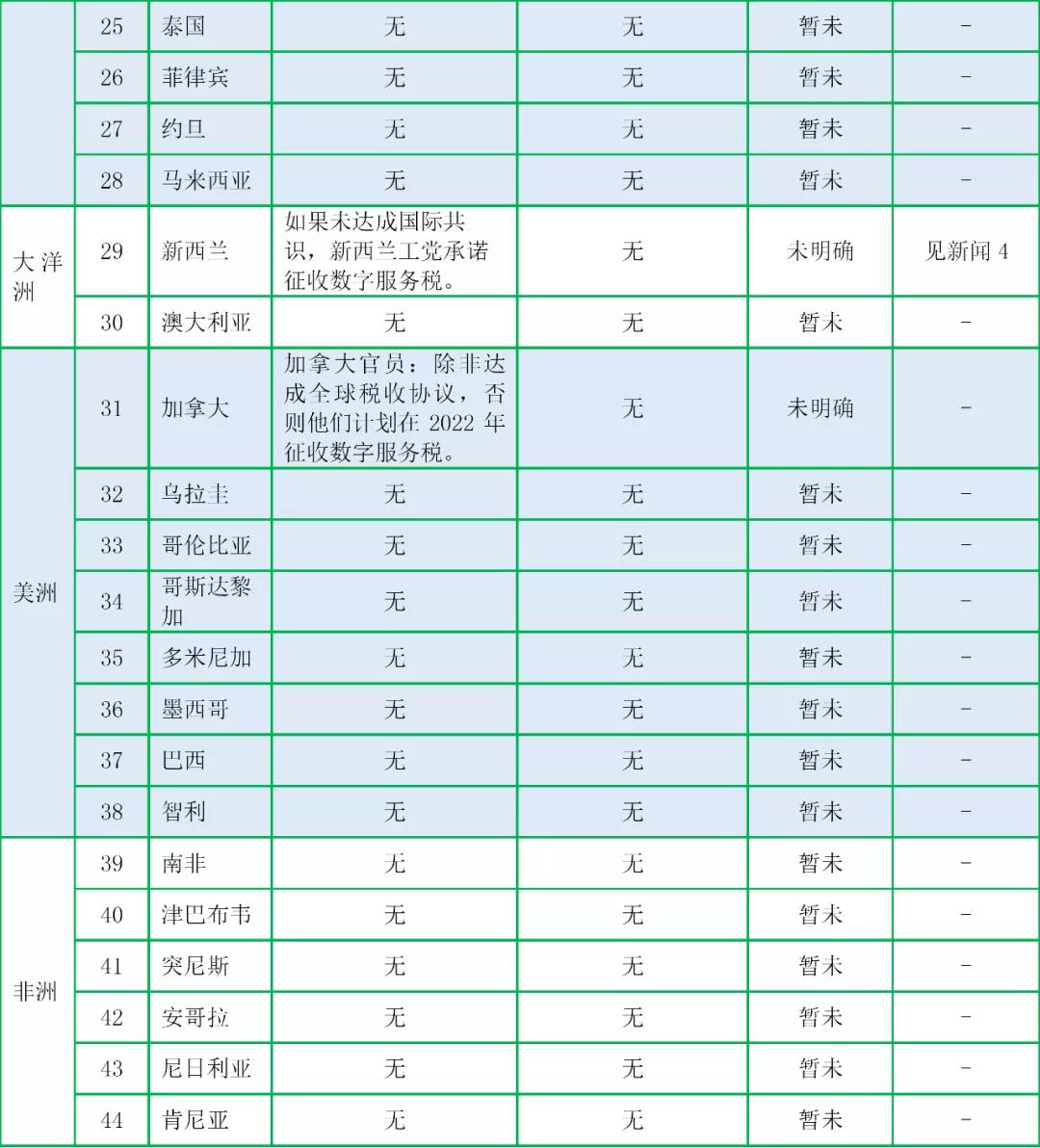

为推动的本轮国际税改协议生效实施,解决数字服务税的争端,美国与欧洲各国积极参与谈判,并就数字服务税的争端达成妥协,详见以下NEWS。据不完全统计,各国就未来是否征收数字服务税与美方谈判或公开表态的情况如下表:

注:根据公开资料汇总整理;截至目前,BEPS包容性框架下141个成员中的137个国家(地区)就“双支柱”解决方案达成共识;包容性框架辖区中肯尼亚、尼日利亚、巴基斯坦和斯里兰卡尚未同意相关方案提议。

新闻1.美国与欧洲五国就数字税争端达成妥协

新闻来源:新华社

时间:2021年10月21日

新华社华盛顿10月21日电 国与奥地利、法国、意大利、西班牙、英国21日宣布就数字服务税争端达成妥协,在经济合作与发展组织推动的国际税改协议生效后,欧洲五国将取消征收数字服务税,美国将放弃对这五国的报复性关税措施。

美国与上述欧洲五国当天发表联合声明称,全球130多个国家和司法管辖区已于10月8日就经合组织推动的双支柱国际税改方案达成协议,以应对经济数字化带来的税收挑战。从一开始,这一国际税改谈判的关键推动力就是要用重新分配跨国企业征税权的共识方案(即支柱一方案)取代单边数字服务税和其他类似措施。

为此,奥、法、意、西、英五国同意在2023年经合组织支柱一方案生效后,取消征收数字服务税。从2022年1月到支柱一方案生效前的过渡期内,如果企业在这五国缴纳的数字税金额超过支柱一方案新规则生效后应缴的税金,其未来在这五国的税收可用超出部分抵扣。作为交换,美国将放弃针对这五国数字税出台的但尚未实施的关税报复措施。

经合组织的支柱一方案要求大型跨国公司在其经营活动所在国也需纳税,以确保规模最大、利润最丰厚的跨国企业利润和征税权在各国之间更公平地分配。这很大程度上是要解决美欧持续数年的数字服务税之争。近年来,法国等欧洲国家积极推动针对谷歌、亚马逊、苹果等大型科技企业在本国的经营活动征收数字税,遭到美国强烈反对。美国随后对多个贸易伙伴的数字服务税发起“301调查”,但美方最后决定暂缓落实相关报复性关税措施,以便推进多边渠道的国际税改谈判。

据悉,支柱一方案实施后,来自全球约100家大型跨国公司的超过1250亿美元利润将被重新分配给各国,其中大部分利润来自美国互联网科技企业。

据美国媒体报道,美国与欧洲五国的联合声明文本显示,如果到2023年12月31日经合组织推动的国际税改协议仍未生效,欧洲五国的数字服务税将继续生效,而美国可实施报复性关税措施。

新闻2.Turkey and US agree on phase-out of digital tax

(土耳其和美国同意逐步取消数字税)

新闻来源:MNE Tax

时间:2021年11月23日

The US Treasury announced on November 22 that it hasreached an agreement with the Turkish government on Turkey’s transition fromits digital services tax to the new taxing rules under the OECD-led October 8international agreement.

The agreement adopts the same terms as those reachedby the US last month with Austria, France, Italy, Spain, and the UK.

The terms allow Turkey’s digital taxes to stay inplace pending implementation of “Pillar One” of the OECD agreement, which wouldreallocate a portion of taxing rights to market jurisdictions. In addition, theagreement allows certain excess amounts paid in digital taxes in the interimperiod by in-scope companies to be creditable against future Pillar Oneliability.

In return for the coordinated withdrawal of Turkey’sdigital tax, the US agrees not to pursue retaliatory trade actions.

新闻3.India and US agree on transition from India’s ‘equalization levy’ digitaltax

(印度和美国同意从印度的“平等征税”数字税过渡)

新闻来源:MNE Tax

时间:2021年11月29日

The US and India have reached a compromise on atransition from India’s “equalization levy” digital services tax towards theterms of the October 8 multilateral agreement on new international taxingrules, according to a November 24 US Treasury announcement.

The announcement does not specify the terms of theagreement between the two countries but states that the “compromise representsa pragmatic solution” and that the countries “have committed to workingtogether through constructive dialogue on this matter.”

In accordance with this agreement, the US willterminate retaliatory trade measures threatened in response to India’sequalization levy.

The Indian government had introduced the equalizationlevy last year and announced proposed expansions earlier this year.

In June, the US had announced retaliatory tariffsagainst India and several other countries in response to their adoption ofdigital taxes, which the US deemed to be discriminatory against US companies.Imposition of the tariffs was suspended pending agreement on a multilateralsolution.

The US agreement with India with respect to phasingout its digital tax follows a similar November 22 agreement with Turkey and anearlier October 21 agreement with Austria, France, Italy, Spain, and the UK.

新闻4.NZ Labour Partypromises digital services tax if international consensus not reached

(如果未达成国际共识,新西兰工党承诺征收数字服务税)

新闻来源:TEEPWEEK

时间:2020年9月24日

The Labour Party, which is the larger of the twoparties in New Zealand's coalition government, has released its tax policyahead of the upcoming New Zealand general election to be held on October 172020. The aspect of the policy that has attracted the most attention fromvoters is a proposal to increase the top personal tax rate from 33% to 39%,with the new 39% rate applying to income over NZ$180,000 (US$120,000) perannum.

Of arguably greater significance to businesses,though, is the Party's policy on the taxation of multinational enterprises. TheParty has said it will "proactively work" with the OECD on "theissue of multinational corporations not paying their fair share of tax".However, if a multilateral solution cannot be found, the Party has said it"will work towards implementation of a digital services tax".

Design of a digital services tax

The Labour Party has not released details as to theform of a digital services tax (DST) except to say that the rate at which theDST applies would be set "once the international position is clear".It is reasonable to assume, though, that a unilateral DST would be based on theframework set out in the government discussion document: 'Options for taxingthe digital economy', which was released in June 2019.

In that discussion document, the government proposed aDST at the rate of 3% on the New Zealand proportion of a multinational group'sgross revenue from certain digital businesses, including intermediationplatforms, social media platforms, content sharing sites and search engines.The discussion document proposed that the DST would apply to businesses with aglobal consolidated annual turnover of at least €750m (US$887m), and annualrevenues attributable to New Zealand from activities within the scope of theDST of at least NZ$3.5m (US$2.3m).

The DST proposed in the discussion document wasprojected to raise between NZ$30m and NZ$80m (US$20m to US$54m) in taxannually. The government's total tax-take is over NZ$80b, meaning that even atthe top end of the range, a DST could be expected to represent no more than0.1% of the government's total tax-take.

Next steps

New Zealand has a mixed member proportional electoralsystem under which a political party's representation in parliament broadlyreflects the proportion of votes cast for that party nationally. Ordinarily, noone party secures an outright majority in parliament, meaning a major partywill usually require the support of one or more smaller parties to secure amajority and form a government.

The Green Party, who are a support partner of thecoalition government, proposes in its tax policy to close "loopholes andareas of under-taxation" for "digital giants". The Green Partyproposes either a unilateral DST of 3% on gross revenues attributable to NewZealand users, or a multilateral solution through the OECD "ifinternational progress can be achieved".

The leader of the largest of the opposition parties,the National Party, has recently acknowledged the challenge of applyingexisting tax rules to the digital economy, stating that “[s]ome of these bigmultinationals now are paying almost no tax anywhere, really, including NewZealand…".The National Party has, however, promised to introduce no newtaxes in its first term of government, if elected, and the party's leader hassuggested that it would be unlikely to implement a unilateral DST.

Commentators have expressed concern at the prospect ofNew Zealand implementing a unilateral DST. The DST is seen as problematic froma tax policy perspective: it is a tax on turnover rather than profit, it posesa high risk of double taxation since it is unlikely to be creditable againstincome tax, and it runs the risk of contravening New Zealand's obligations atinternational law (under double tax agreements or trade-related agreements).Moreover, other countries that have legislated, or even proposed, a unilateralDST have drawn the threat of retaliatory measures from the US.

With progress at OECD level looking uncertain, thereis a real prospect of the Labour Party, if it forms part of the governmentafter the election, proceeding to implement a unilateral DST. It is to be hopedthat the government would carefully consider the costs and risks ofimplementing a DST, in light of the relatively small amount of tax revenue aDST would raise.